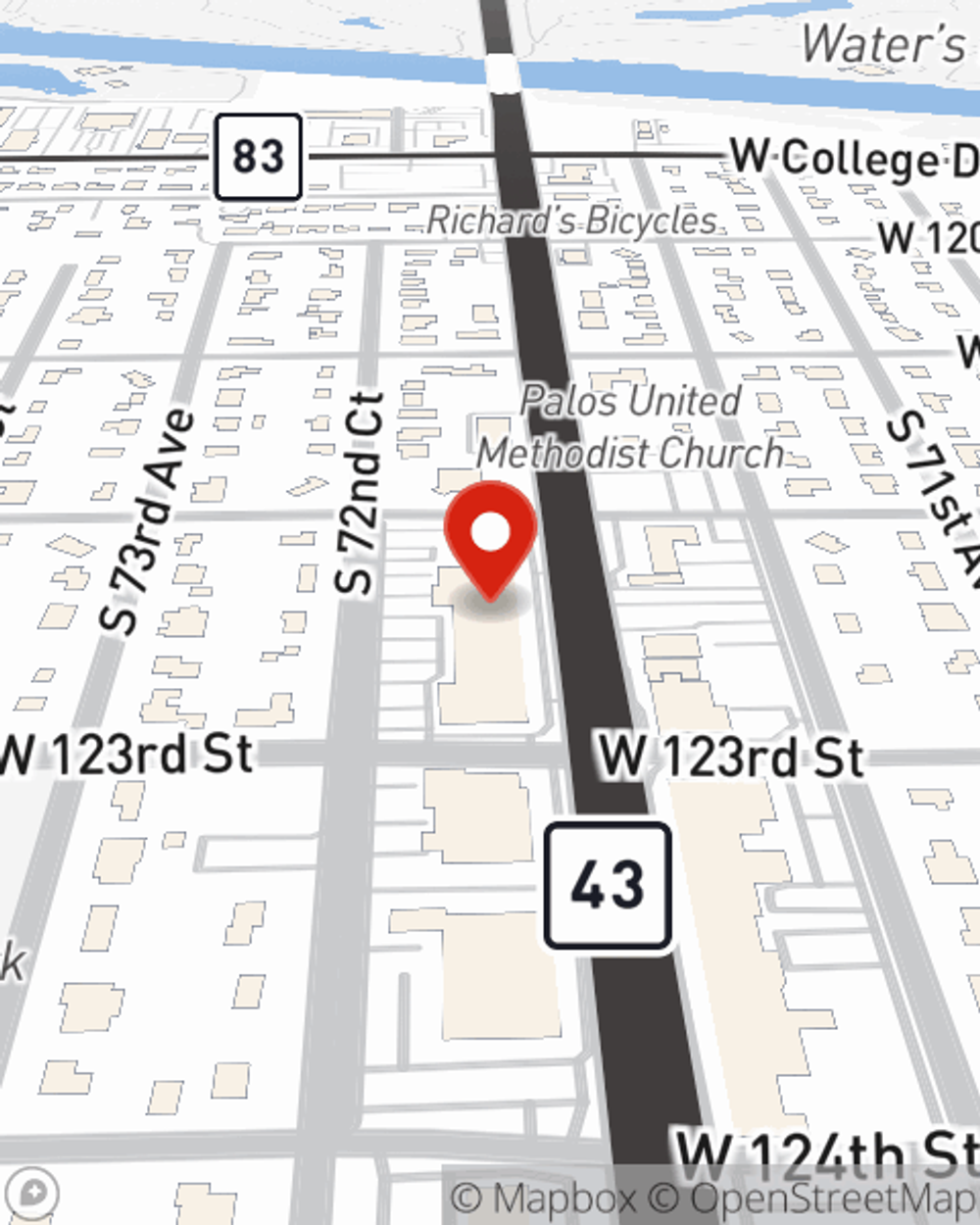

Business Insurance in and around Palos Heights

One of the top small business insurance companies in Palos Heights, and beyond.

Insure your business, intentionally

State Farm Understands Small Businesses.

Do you own a hobby shop, a cosmetic store or an ice cream shop? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

One of the top small business insurance companies in Palos Heights, and beyond.

Insure your business, intentionally

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, commercial auto or surety and fidelity bonds.

The right coverages can help keep your business safe. Consider visiting State Farm agent Chad Alfano's office today to discover your options and get started!

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Chad Alfano

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.